After my “Shingo Investing” analysis last week, someone asked “what about the Industry Week Best Plants winners?”

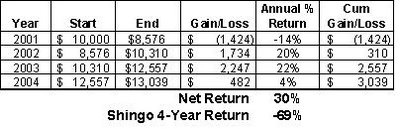

I conducted a similar analysis. Because the IW awards are typically given in October, I looked at the stock prices from Oct 1 to Oct 1 each year. With the stock data that I had handy, it was only easy to go back to 10/1/2001. So, the “2001” year shows stock returns from 10/1/2001 to 9/30/2002. The last winners I analyzed were the 2004 winners, looking at their stocks up until 9/30/2005.

Industry Week award winners did much better than the Shingo winners over the past four years. The total return was positive. Yes, we can call it a return rather than a loss. The four-year gain for the IW portfolio was 30%, compared to a four-year loss in the Shingo portfolio of 69%.

2004 IW winners with publicly traded stock were (with notable stock changes): Boeing (up 31%), Dana (down 47%), Guidant, Maytag, Northrop Grumman, and Rockwell Automation (up 35%).

2003 IW winners: Autoliv (up 28%), Boston Scientific (down 38%), Dana, Delphi, General Cable (up 32%), Textron (2 plants, up 58%), and Lockheed (up 18%).

2002 IW winners with notable stock gains: Siemens (up 75%)

2001 IW winners with notable stock changes: Dell (up 34%), Kodak (down 24%), Northrop (down 43%), MKS Semiconductor (down 37%).

So am I willing to bet my retirement fund on the 2005 or this year's upcoming 2006 winners? Hmmm…. not sure.

IW Best Plants isn't a “lean prize” per se, but there are many lean companies in the IW list and there's some overlap with Shingo winners. Here's the criteria for winning, you can see it's much more broadly defined. Being a lean company (or even just a lean factory) whould lead to improvements in all of the areas IW looks for, except maybe for “application of new technologies.”

A panel of IW editors reviewed the applications, which reported management practices and plant performance in such areas as quality, customer and supplier relations, employee involvement, application of new technologies, productivity, cost reductions, manufacturing flexibility and responsiveness, inventory management, environmental and safety performance, new-product development, and overall market results.

Why is it that IW Best Plants stocks are “winners” while Shingo stocks are “losers,” in general. What do you think? Click “comments.”

What do you think? Please scroll down (or click) to post a comment. Or please share the post with your thoughts on LinkedIn – and follow me or connect with me there.

Did you like this post? Make sure you don't miss a post or podcast — Subscribe to get notified about posts via email daily or weekly.

Check out my latest book, The Mistakes That Make Us: Cultivating a Culture of Learning and Innovation:

I’m not sure whether maximising external shareholder return is the main objective for lean organisations!

The reality of the world is that, if you’re public, you better make Wall Street happy. In theory, long-term performance is what really counts, but Wall Street over-values short-term performance.

Hi Mark, have to agree with you there.

I’m doing some research soon for a course that will include touching on lean from a financial perspective. I’ll let you know what if I discover anything interesting.